Beyond Our Bubble: My Adventures Exploring the Global Layers of the Credit Union Movement

This article first appeared on CUInsight.com.

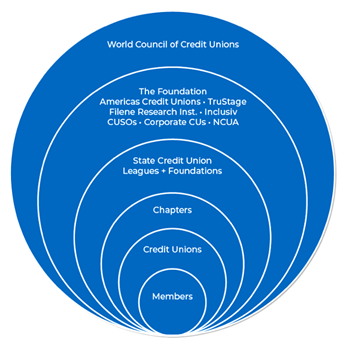

Most of us growing up in Credit Union Land are familiar with the Credit Union Onion. You know, the round circles that show the member at the core and all the supporting players as you move to the outer circle? I first saw the onion diagram in my Credit Union Development Educator program in Madison (best class ever, of course . . . IYKYK) and I knew right away it would become one of my favorite ways to explain our movement. According to Google, it originated at CUNA — now America’s Credit Unions — and it brilliantly captures how we’re all connected. It really sets the stage for thinking of our industry as a true collective that extends far beyond our own bubble.

Most of us growing up in Credit Union Land are familiar with the Credit Union Onion. You know, the round circles that show the member at the core and all the supporting players as you move to the outer circle? I first saw the onion diagram in my Credit Union Development Educator program in Madison (best class ever, of course . . . IYKYK) and I knew right away it would become one of my favorite ways to explain our movement. According to Google, it originated at CUNA — now America’s Credit Unions — and it brilliantly captures how we’re all connected. It really sets the stage for thinking of our industry as a true collective that extends far beyond our own bubble.

Depending on how engaged someone is in our movement, most people get at least a couple layers into the onion—hopefully at least as far as the national associations and partners at some point in their career. But many don’t venture beyond the credit union they work for. They stay focused on their members and their day-to-day responsibilities, without getting involved in chapters or connecting nationally. I’ll admit, I’ve never fully understood the motivation for that kind of isolation. I’ve seen plenty of small credit unions, with limited staff and resources, dive several layers deep because the people there are simply passionate about being part of something bigger.

Stretching ourselves to the onion’s outer layer—the global credit union movement—is where we tend to lose some people. And to be honest, I didn’t make my way out there until I became a league president. Before that, I had never attended a World Council of Credit Unions (WOCCU) conference. I’d seen photos from people working in Africa, Ireland and other places, but I didn’t fully understand the “why” behind that work until my first WOCCU event. Standing in Vancouver in 2023, as the parade of flags opened the conference, something clicked. In that moment, watching people from all over the world gather under one cooperative banner made me realize I was part of something far bigger than I had previously realized.

Long before I started at the Michigan Credit Union League (MCUL), our league had partnered with Macedonia to help form the first credit union there. A small group had also traveled to Africa to support work through the World Credit Union Foundation. But after those efforts, our engagement at the global level had quieted. When I became CEO, I wanted to change that. As I began talking with colleagues like John McKenzie in Indiana and Murray Williams in Iowa, I learned about the programs and partnerships their leagues had built with credit union systems around the world.

My next call was to Mike Reuter, President of the Worldwide Foundation for Credit Unions, to learn more about their Global Bridges programs. I had gotten to know Mike during the early days of the war in Ukraine in 2022, when Michigan credit unions banded together to support Ukrainian credit unions and their members after the Russian invasion, and Mike was leading that national response. This year, my call to him was to ask whether any leagues or credit unions were currently seeking support. It didn’t take long for Mike to share that the Bahamas Co-operative League was looking for a U.S. league partner to explore forming their very first CUSO.

That conversation started our journey with the Bahamas League. In the Caribbean, smaller regions each have their own league, and those leagues come together under the Caribbean Confederation of Credit Unions, which provides support across the region. Think of it as the America’s Credit Unions of the Caribbean!

With the support of the MCUL Board, we formed a small delegation and began working closely with Denise Garfield from the Caribbean Confederation of Credit Unions and Candice Bain, General Manager of the Bahamas League, as well as Mike Reuter. We held several Zoom calls with their leagues and with the presidents of the six credit unions that make up the Bahamas League. Those conversations led to our delegation’s trip to Nassau this November for a weeklong workshop and series of visits. We spent two days in a classroom setting exploring CUSO ideas, current needs, collaboration, and payments. Afterward, our Michigan delegation—joined by a small group from VyStar Credit Union—visited all six Bahamas credit unions to hear firsthand about their operations, challenges, and successes.

Our delegation in the Bahamas

While in the Bahamas, it became clear very quickly that their credit unions face many of the same challenges we see in Michigan: attracting younger members, planning for leadership succession, raising awareness, managing rising compliance costs, and keeping up with technology. These issues truly have no borders. One of the big takeaways for our delegation was how much their system resembles where Michigan credit unions were several decades ago. Most Bahamas credit unions were formed in the 1970s and later, so they’re still relatively young and working through many of the same growing pains our credit unions experienced in the 1950s and 1960s.

We all know how much our communities have benefited from being part of their credit unions, and how U.S. credit unions are increasingly collaborating through the CUSO structure. Sharing those ideas—from growth strategies to ways of working together—can help strengthen the Bahamas credit unions and support the long-term stability of their system.

Our work with the Bahamas League is far from finished, and we’ll continue meeting virtually to support them and build on what we’ve learned together. But this isn’t a one-way street. Our delegation came home with a renewed sense of why it’s so important to keep the credit union flame burning, and with fresh energy to tackle our own challenges—many of which mirror what credit unions face around the world. As a league, we also walked away with new ideas for how we can better support our Michigan credit unions, and we’ll be exploring how to put those takeaways into action.

I share this experience with you, dear reader, to plant a small seed: take another look at the onion. How far are you pushing yourself, and your team, toward those outer layers? Talk about what can be learned from partners and peers beyond your state and even beyond our country. And if you can, consider attending next year’s WOCCU event to experience firsthand the worldwide excitement, hope, and strength behind this movement that has given us all so much.

« Return to "Patty's Desk"

- Share on Facebook: Beyond Our Bubble: My Adventures Exploring the Global Layers of the Credit Union Movement

- Share on Twitter: Beyond Our Bubble: My Adventures Exploring the Global Layers of the Credit Union Movement

- Share on LinkedIn: Beyond Our Bubble: My Adventures Exploring the Global Layers of the Credit Union Movement