August 26, 2025

Dear Credit Union Leaders,

The weather is turning cooler and football starts for real this weekend! As Fall gets closer, here are the updates you need.

Advocacy

In Lansing, the state legislature has returned from its summer recess and has re-started budget negotiations in earnest. Late Tuesday, the House Majority signaled its intent to introduce and pass a first-chamber plan – details remain thin as this develops, but we expect the initial offering will see significant reductions in certain departments and areas. While negotiations continue, work is slowly accelerating on policy initiatives:

- SB 361-364, related to data breach and privacy protections as well as amending the state Consumer Protection Act passed the Senate this week. The legislation would update and heighten regulations on affected businesses, but would largely exempt credit unions, banks, and other highly regulated industries. Portions of the package are concerning, in particular those creating fairly invasive investigatory provisions for the Attorney General’s Office. However, as the package arrives in the House for further consideration, it is anticipated that further amendments would be needed to gain support. MCUL is neutral on the portions of this package that don’t affect credit unions, and have shared our concerns with lawmakers on remaining portions.

In Washington D.C., Congress remains on August recess. However, work on the National Defense Authorization Act continues, and amendments are being filed by offices. The following recent items were noteworthy:

- H.R. 2808, the Homebuyers Privacy Protection Act dealing with mortgage trigger leads, was passed in the Senate and sent to the President for signature. The bill prohibits a credit reporting agency from providing a consumer's credit report to a third party in connection with a residential mortgage transaction unless the transaction consists of a firm offer of credit or insurance and either the third party provides documentation certifying that it has the consumer's consent; or the third party has originated a mortgage on behalf of the consumer, is a current mortgage loan servicer to the consumer, or has a current specified banking relationship with the consumer (ie. is their bank or credit union). MCUL, America’s Credit Unions, and the state Leagues support the bill.

- U.S. Sen. Elissa Slotkin joined U.S. Sen. Gary Peters as a co-sponsor of S. 522, the Senate version of the Credit Union Board Modernization Act. The bill would allow federally chartered credit unions in good standing to convene their boards of directors 6 times per year instead of 12. There are now 44 co-sponsors of the bill in the Senate. H.R. 975, the House’s version spearheaded by U.S. Reps. Bill Huizenga and Juan Vargas (D-CA), passed that chamber earlier this year and awaits further consideration in the Senate. Michigan’s U.S. Rep. Hillary Scholten is also among that bill’s 22 co-sponsors. MCUL, America’s Credit Unions, and the state Leagues support both versions of this bill, and urge swift action to bring this issue to passage.

- H.R. 4544, the American Access to Banking Act, advanced out of the U.S. House Financial Services Committee’s markup. This legislation would address persistent and burdensome challenges to formation that new credit unions and community banks face. It would require federal financial regulators to review and streamline the application process to create a bank or credit union; establish mentorship and outreach programs; improve capital formation pathways; establish dedicated points of contact for applicants through casework support; encourage greater collaboration between federal and state regulators. America’s Credit Unions and the state Leagues support the bill.

- H.R. 4735 and S 2419, dual versions of the Business of Insurance Regulatory Reform Act, were introduced to ensure the CFPB does not expand its authority under the Consumer Financial Protection Act (CFPA). The bills would amend the CFPA to revise the authority of the CFPB over activities regulated by a state insurance regulator by exempting the business of insurance from CFPB oversight. America’s Credit Unions and the state Leagues support the bill.

- As a reminder, last month, Congress passed S. 1582, the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act to create a federal regulatory framework for stablecoin. It was signed on July 18; implementation and assessing industry impacts will now be a top priority for many segments of the financial and retail industry. America’s Credit Unions and the state Leagues were supportive of aspects of the bill, including empowerment of CUSOs in this space.

Grass Roots and Advocacy Funding

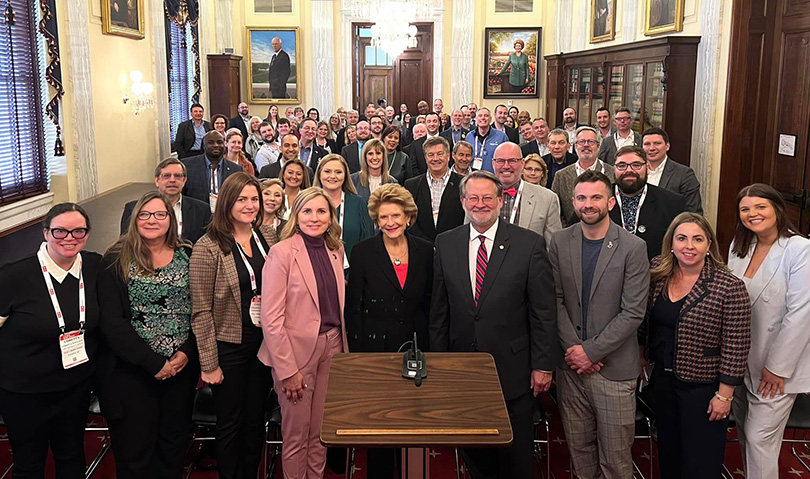

Hike the Hill is September 15-17 in Washington D.C. You can access details and hotel information at Hike the Hill - Michigan Credit Union League, and please contact Todd (Todd.Jorns@mcul.org) with any questions. For questions on scholarships, please contact Laura (Laura.Osminksi@mcul.org) or Kieran (Kieran.Marion@mcul.org). Additionally, America’s Credit Unions Congressional Caucus is coming up September 7-9, also in Washington D.C. If you or someone from your credit union is planning to attend, please contact Todd for information on Hill Visits.

If you are near Marquette on October 2, keep your eye out for details soon on a new “PAC U.P. the Pub!”event to benefit our state PAC! Also, please stay tuned for details on “hYPe the Hill” – a young professional-focused advocacy day in Lansing in early November! Details are coming soon!

News about next year’s America’s Credit Unions GAC will begin to flow in September. Michigan will have a block of rooms once again this year. Once we receive them, our team will be working through the most efficient way to help ensure that those that need hotel rooms have access to them. Please contact Todd with any questions, and stay tuned.

Elections

Former U.S. Rep. Mike Rogers still remains the only formally announced candidate for the Republican nod for U.S. Senate next year. There have been no recent additions into the Democrat’s primary race for the U.S. Senate seat. However, former state House Speaker Joe Tate did announce last month that he has withdrawn his name from the race. This leaves state Sen. Mallory McMorrow, Dr. Abdul El-Sayed, and U.S. Rep. Haley Stevens as the announced candidates in that field.

Lt. Gov. Garlin Gilchrist II, Secretary of State Jocelyn Benson, and Genesee County Sheriff Chris Swanson have all announced they will seek the Democrat nomination for Governor next year, along with Detroit Mayor Mike Duggan seeking the office as an Independent. Former Attorney General Mike Cox, U.S. Rep. John James, state Senate Minority Leader Aric Nesbitt, and former state House Speaker Tom Leonard have announced they will seek the Republican nomination.

As always, thank you for all that you do for Michigan’s credit unions!

« Return to "Advocacy"