FHLBank Indianapolis Increases HomeBoost Allocation to $2.5 Million

In an effort to help make homeownership more equitable in Indiana and Michigan, the Federal Home Loan Bank of Indianapolis (FHLBank Indianapolis or Bank) has allocated $2 million in additional funds for the Bank’s pilot HomeBoost minority down payment assistance program.

HomeBoost, announced by the Bank in early July with an initial startup of $500,000, provides $15,000 in down payment assistance to those who are first time homebuyers; identify as Black or African American, Asian, Hispanic, Indian American or Alaska Native, and/or Native Hawaiian or Other Pacific Islander; have a household income at or below 120% of the local Area Median Income; and intend to purchase a primary residence in Indiana or Michigan.

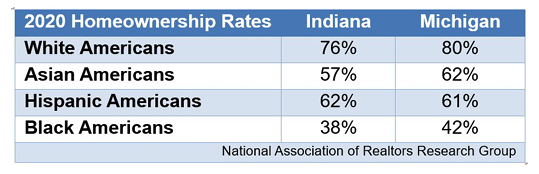

According to HUD’s Office of Fair Housing and Equal Opportunity on Dec. 7, 2021, “the BlackWhite homeownership gap is wider today than it was in 1968 when the Fair Housing Act became law.” The Bank’s district of Indiana and Michigan is no different than the national trends:

“We are thrilled to announce additional funds have been added to our pilot HomeBoost program,” said MaryBeth Wott, SVP Community Investment and Strategic Planning Officer. “This program is an excellent tool for our members to utilize and help address the racial homeownership gap within the communities they serve and our larger district of Indiana and Michigan as a whole. We look forward to helping eligible households get one step closer to buying their first home.”

The program will launch in September 2023. Households will be assisted first-come, first-served until funds are exhausted or by March 4, 2024, whichever occurs first. Only participating FHLBank Indianapolis member financial institutions can submit HomeBoost grant applications on behalf of eligible households. Learn more about HomeBoost and other Community and Housing programs offered by FHLBank Indianapolis at www.fhlbi.com.

« Return to "MCUL Newsroom"