Page 7 - Michigan Credit Union League: CU Impact Report

P. 7

FALL 2020 CREDIT UNION IMPACT REPORT 7

COMMUNITY ASSISTANCE

QUICK, CREATIVE SOLUTIONS About 10,000 emergency cash loans were reported,

which covered more than $23 million for members.

FOR MILLIONS HIT BY COVID-19 These loans usually carried a 0% loan rate and

provided an average of $2,300 per borrower —

The first order of business for Michigan credit unions essential funds for paying rent or just putting food

following the news of Gov. Whitmer’s “Stay Home, on the table.

Stay Safe” Executive Order, was making sure they

could provide for members while remaining within Moreover, members were issued more than 260,000

the health guidelines provided by the state and skipped payments, resulting in more than $1 billion

Centers for Disease Control and Prevention. in payment delays to help offset income loss-related

financial hardship.

Suddenly, Michigan’s unemployment rate went

from less than 5% to nearly 25% in April. Hundreds of Nearly all of the credit unions polled reported

thousands of residents needed financial assistance offering fee waivers, ranging from waiving fees for

immediately, and the Michigan credit union late payments, skip-a-pays, early CD withdrawals,

movement was there for them. Insufficient funds, negative balance fees, ATM

overdrafts and more. Together, more than 600,000

Credit unions around the state found creative ways waivers saved members $12.7 million.

to offer assistance to members, whether they were

consumers struggling with monthly payments or In addition to these relief options, 80% of credit

small business owners uncertain of the short-term unions provided member safety and security services,

future of their business. such as financial counseling, debt consolidation,

paused repossessions and others.

While some credit unions focused on formal, time-

tested relief options — fee waivers, skip-a-pays, “These numbers are very powerful and speak to the

deferral options and emergency relief loans, to name overwhelming impact our not-for-profit movement

a few — others worked with individual members to has on the lives of millions of Michiganders,” said

see what worked for them. Alongside products, the MCUL CEO Dave Adams. “Once again, we showed

movement across the board took this opportunity that when a crisis hits, you can always turn to your

to educate members in need, offering budget local credit union.”

assistance or, for some business owners, sitting down

with them to look at reopening plans.

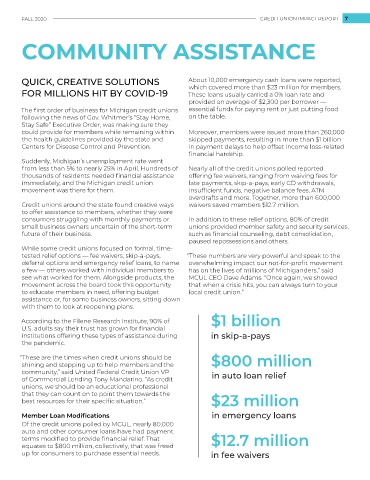

According to the Filene Research Institute, 90% of $1 billion

U.S. adults say their trust has grown for financial

institutions offering these types of assistance during in skip-a-pays

the pandemic.

“These are the times when credit unions should be $800 million

shining and stepping up to help members and the

community,” said United Federal Credit Union VP in auto loan relief

of Commercial Lending Tony Mandarino. “As credit

unions, we should be an educational professional

that they can count on to point them towards the

best resources for their specific situation.” $23 million

Member Loan Modifications in emergency loans

Of the credit unions polled by MCUL, nearly 80,000

auto and other consumer loans have had payment

terms modified to provide financial relief. That $12.7 million

equates to $800 million, collectively, that was freed

up for consumers to purchase essential needs. in fee waivers