Page 6 - MCUL: 2020 CU Impact Report

P. 6

6 CREDIT UNION IMPACT REPORT SPRING 2020

TRUST THAT CREDIT UNION

MEMBERS CAN RELY ON

The relationship between credit union and

THE NOT-FOR-PROFIT BENEFITS

member is based in trust. The cooperative, $482 Million

not-for-profit model, where members are also

owners, means members can trust they’re

dealing with a financial institution not set on in Direct Financial

profits, but benefits — benefits for the consumer. Benefits to

People respond to low-cost products and services

created for financial health, not the highest $5.5 Million

profit, and that’s what we’re seeing in Michigan,

where credit union memberships are outpacing

population growth. Members

The Credit Union National Association (CUNA)’s

Q3 data reported that, in the previous 12 months,

Michigan credit unions provided $482 million in

direct financial benefits to the state’s 5.5 million

members — an increase to the already impressive $89

$424 million recorded in the preceding quarter.

Per Member

What does this mean? It means each Michigan

credit union member is getting an estimated

$89, or $187 per household, in direct financial

benefits. CUNA calculates these stats based

on average savings differences between credit

union and bank pricing, and result from financial $187

benefits, such as higher CD rates and fee-free

checking, as well as lower rates and fees on Per Household

products like home, car and auto loans.

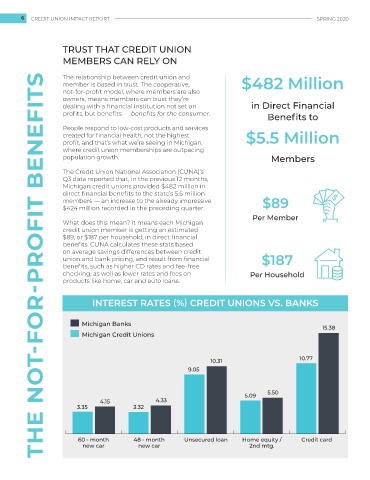

INTEREST RATES (%) CREDIT UNIONS VS. BANKS

Michigan Banks

15.38

Michigan Credit Unions

10.31 10.77

9.05

5.09 5.50

4.15 4.33

3.35 3.32

60 - month 48 - month Unsecured loan Home equity / Credit card

new car new car 2nd mtg.