Page 5 - 2022 Impact Report

P. 5

CREDIT UNION IMPACT REPORT 5

NOT-FOR-PROFIT BENEFITS

MEMBERS OWN, MEMBERS EARN

$556

Credit unions set themselves apart from other financial institutions

with their cooperative, not-for-profit structure. When you’re a million

member of a credit union, you’re also an owner of the credit union.

This structure creates a true partnership between member and credit in direct financial

union — a partnership that, through mutual benefit, fosters trust.

benefits to

Based on average savings differences between credit union and

bank pricing on products and services, such as higher CD rates and 5.77 million

fee-free checking, as well as lower rates and fees on products like

home, car and auto loans Michiganders earn a significant profit

simply by being a credit union member. members

The Credit Union National Association (CUNA)’s Member Benefits

Report for Q3 2021 reports that Michigan credit unions contributed

to a total of $556 million in direct financial benefits to Michigan’s

5.77 million members over the previous twelve months. This total is

equal to $98 per member or $205 per household.

According to CUNA, financing a $25,000 vehicle for 60 months

through a credit union, rather than a bank, will save consumers an

average of $166 annually in interest. This figure has increased nearly

28% in the last year. This is just one of many savings benefits that $205

are helping members more easily meet their needs.

per household

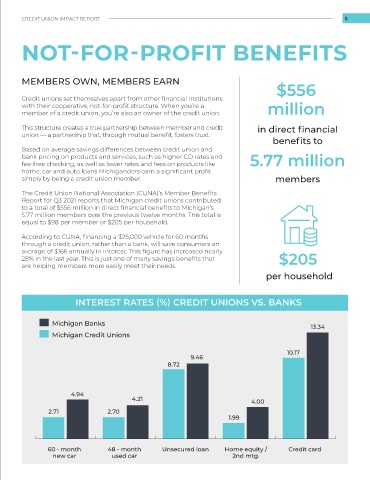

INTEREST RATES (%) CREDIT UNIONS VS. BANKS

Michigan Banks

13.34

Michigan Credit Unions

10.17

9.46

8.72

4.94

4.21 4.00

2.71 2.70

1.99

60 - month 48 - month Unsecured loan Home equity / Credit card

new car used car 2nd mtg.